Why B2B Marketers Get Their Signs Mixed Up When They Use Intent Data

by editor

Do you know that you have your own info on intent? You don’ need to get it. If you run campaigns, especially on accounts you already have, you have access to much more detailed info than you could buy.

It’s only important that you know where and how to look for it. When you find it, you’ll know that what people are selling or telling you about “signals” isn’t really true.

What intent signs really mean

People who work as marketers have told us that a prospect’s desire for information is linked to their interest in your business or product. People think that if someone responds to an offer, it means they’re “in the market to buy.”

It’s a belief that this is true, but it’s not. If you don’t know much about a buyer’s personality, you can’t be sure that they are “actively searching” for what you have to offer just because they showed “purchase intent.” You would need to watch them over time to see if this happens.

We looked at engagement and intent data from seven industries and thousands of contacts and only found a small number of cases (5–10%) where this was true. When you look at your own records, you will find the same thing.

Since 5% of the people you want to reach are in the buying cycle at any given time, this makes sense. Even more interesting is what’s in the 95% of data you don’t buy or analyze.

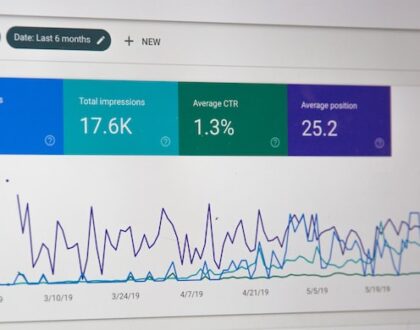

Looking at your own data on interest

Here is what you need to know to look at your own data on interest. First, get account-level data from your marketing and sales tools. We don’t have time to think about what happened in the past very often because we’re so busy carrying out our plans. Based on how long the sales cycle is, you should get contact data from the last 12 to 18 months.

Get information from 10 accounts to begin. Based on the value of the stream, these 10 accounts could be the biggest or most important ones. Then, look at the places below.

Getting involved over time

This number is important because it shows how much of a buyer’s or contact’s mind they have. Check to see how they have responded to your messages in the last 12 to 18 months.

Is it a “burst”? (For instance, a C-level engages more than once a month.) Or is it “consistent,” showing up for a few events over a longer period of time?

Time of engagement

How long did they look at your offer? Did it take seconds or milliseconds? This helps you figure out how interested they are. Are they quickly looking over what was sent, or did they look into it more?

Number of engagements

Did they hit the same thing more than once in one day or over time? This could be a sign that they are sending information to other people. It also lets you know who in the account might be the “router” of information.

Offer of engagement

What are they interested in (i.e. what deal or outreach)? Do they see invitations to webinars, new case studies, the magazine, or something else? If you have 10 accounts, you’ll really understand what material is important.

Figuring out what participation really means

By looking at your engagement data, you can tell if people are interested in your brand, your solution, or just what you have to give.

The offer is what it is most of the time. That is a great idea, though, because it helps you focus on the things that matter to your viewers.

Content gives a seller a chance to be seen as helpful. It doesn’t tell you if the target is in a buying window or at a certain point in the buyer’s journey, which is a shame.

By showing the sales team how and what people are interested in, they can focus on getting to know each other. By getting a better sense of why people do the things they do, you can figure out what drives them. The signal turns into knowledge.

Like, did they look at your invite to the upcoming workshop or user conference? How many times did they look at it? How many emails did they open that were about those events? Did they show up to the event? You now know they were interested if they didn’t say no.

This gives the salesperson a chance to offer a form of the webinar that can be watched whenever it’s convenient for the customer, or even a free pass to the event next year. They’re building a relationship with you based on mutual interest, not by trying to sell you a solution you haven’t shown any real interest in.

Recommended Posts

Can Attentiveness Actually Drive Campaign Success?

November 8, 2024

Marketers Must Create Time for Time Management

October 25, 2024

Maximizing Revenue Growth Through Sales and Marketing Alignment

October 11, 2024